Living Smart On A $60K Per Year New York Budget: Practical Tips And Insights

Living in New York City is a dream for many, but with its high cost of living, making ends meet on a $60K per year budget can seem like a daunting challenge. However, with careful planning, strategic spending, and a little creativity, it is entirely possible to thrive in the Big Apple while sticking to this income. From housing and transportation to dining and entertainment, every aspect of your financial life can be optimized for a comfortable and fulfilling lifestyle.

New York City is known for its vibrant culture, career opportunities, and world-class amenities, but it’s also infamous for being one of the most expensive cities in the world. For individuals or families earning $60,000 annually, finding a balance between enjoying the city’s offerings and managing finances requires an intentional approach. Whether you’re a recent college graduate embarking on your career, a professional looking to settle down, or a small family aiming to budget wisely, this guide aims to provide actionable steps to make the most of your income.

In this comprehensive guide, we’ll break down the essentials of living on a $60K per year New York budget. You’ll find tips on affordable housing options, effective transportation strategies, ways to save on groceries, and insights into free or low-cost entertainment. Let’s dive into the details and uncover how you can live a financially secure and enjoyable life in the city that never sleeps.

Read also:Tawog Rule 34 A Comprehensive Guide With Insights

Table of Contents

- Is $60K Enough to Live in NYC?

- How to Budget Effectively on $60K?

- Affordable Housing Options in New York

- Transportation Tips to Save Money

- Managing Food and Grocery Expenses

- Free and Low-Cost Entertainment in NYC

- Can You Save for the Future on a $60K Salary?

- How to Handle Debt on a $60K Budget?

- Finding Healthcare Within Your Budget

- Childcare and Education on a $60K Budget

- How to Build an Emergency Fund on $60K?

- Balancing Lifestyle and Financial Goals

- Side Hustles to Boost Your Income

- Is It Worth Living in NYC on $60K?

- Frequently Asked Questions

Is $60K Enough to Live in NYC?

Living on $60K per year in New York City is possible, but it comes with its fair share of challenges. The key lies in understanding the city’s cost of living dynamics and prioritizing your spending. Here are a few factors to consider:

- Housing Costs: Rent is typically the largest expense for New Yorkers. On a $60K salary, dedicating no more than 30% of your income to housing is crucial. This means finding a rental that costs around $1,500 per month or less.

- Transportation: The city’s public transit system is one of the best in the world, and a monthly MetroCard can save you hundreds compared to owning a car.

- Lifestyle Choices: Dining out, entertainment, and shopping must be done mindfully to stay within your means.

While $60K may not afford you a luxury lifestyle, it is sufficient for a modest yet comfortable living with proper planning.

How to Budget Effectively on $60K?

Creating a budget is the cornerstone of financial stability, especially in an expensive city like New York. A well-structured budget ensures that your income covers both necessities and occasional indulgences. Here’s how to get started:

- Track Your Income and Expenses: Use a budgeting app or a simple spreadsheet to monitor your cash flow. Categorize your spending into essentials (rent, groceries, utilities) and non-essentials (entertainment, dining out).

- Follow the 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment.

- Set Clear Financial Goals: Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having specific goals motivates you to stick to your budget.

Consistency is key. Review your budget regularly and adjust as needed to stay on track.

Affordable Housing Options in New York

Finding affordable housing in New York City is challenging but not impossible. Consider the following strategies:

- Look Beyond Manhattan: Neighborhoods in the outer boroughs, such as Queens, Brooklyn, and the Bronx, often offer more affordable rent.

- Roommates: Sharing an apartment with roommates can significantly reduce your housing costs.

- Subsidized Housing Programs: Research programs like NYC Housing Connect, which offers affordable housing lotteries.

With some research and flexibility, you can find a home that fits your budget without sacrificing convenience or safety.

Read also:Raul Jimenez Mexico A Football Stars Journey

Transportation Tips to Save Money

Transportation in NYC doesn’t have to break the bank. Here’s how you can save:

- Use Public Transit: A monthly MetroCard costs $127 and provides unlimited subway and bus rides.

- Consider Biking: NYC is becoming increasingly bike-friendly with Citi Bike and dedicated bike lanes.

- Walk More: Many neighborhoods are walkable, allowing you to save on transit costs while staying active.

These strategies not only save money but also reduce your carbon footprint.

Managing Food and Grocery Expenses

Food is another major expense in NYC. To manage costs effectively:

- Cook at Home: Preparing meals at home is significantly cheaper than dining out.

- Shop at Discount Stores: Stores like Trader Joe’s and Aldi offer affordable grocery options.

- Meal Prep: Planning your meals for the week reduces waste and saves time.

Occasional dining out is fine, but prioritize cooking at home to stretch your budget further.

Free and Low-Cost Entertainment in NYC

New York City offers a wealth of free or low-cost activities:

- Attend free events at parks and community centers.

- Explore the city’s museums on free admission days.

- Enjoy outdoor activities like walking the High Line or visiting Central Park.

You don’t have to spend a fortune to enjoy the city’s vibrant culture and attractions.

Can You Save for the Future on a $60K Salary?

Yes, you can save for the future on a $60K salary. Start by:

- Building an emergency fund with 3-6 months of living expenses.

- Contributing to a retirement account like a 401(k) or IRA.

- Automating your savings to make it a consistent habit.

Even small contributions add up over time, helping you secure your financial future.

Frequently Asked Questions

1. Can a single person live comfortably in NYC on $60K per year?

Yes, a single person can live comfortably on $60K per year with careful budgeting and by prioritizing affordable housing, cooking at home, and using public transit.

2. What are the best neighborhoods in NYC for affordable living?

Neighborhoods like Astoria in Queens, Bay Ridge in Brooklyn, and Inwood in Manhattan offer more affordable living options while maintaining good amenities.

3. Is $60K enough to support a family in NYC?

Supporting a family on $60K in NYC is challenging but possible with strict budgeting, affordable housing, and utilizing public resources like free parks and libraries.

4. How can I reduce my utility bills in NYC?

Reduce utility bills by using energy-efficient appliances, unplugging unused devices, and taking advantage of natural lighting whenever possible.

5. Are there any tax breaks for NYC residents on a $60K salary?

Yes, NYC residents may qualify for tax credits like the Earned Income Tax Credit (EITC) and renters’ tax credits, depending on their circumstances.

6. What’s the average rent for a one-bedroom apartment in NYC?

The average rent for a one-bedroom apartment in NYC ranges from $2,000 to $3,000, but more affordable options can be found in outer boroughs or through shared living arrangements.

Conclusion

Living on a $60K per year New York budget requires discipline, creativity, and a proactive approach to managing your finances. By focusing on affordable housing, efficient transportation, mindful spending, and strategic saving, you can enjoy the many opportunities that NYC has to offer without compromising your financial stability. Remember, it’s not about how much you earn but how well you manage your resources that determines your quality of life in the Big Apple.

Whether you’re a lifelong New Yorker or new to the city, these tips will help you thrive on your $60K budget. With determination and the right strategies, you can turn your financial challenges into opportunities and truly enjoy all that New York City has to offer.

Everything You Need To Know About Iykyk Wonhee

Sudan Asian Mixed Heritage: A Rich Tapestry Of Culture And Identity

The Timeless Appeal Of Cornrows Hairstyle: A Cultural And Modern Hair Trend

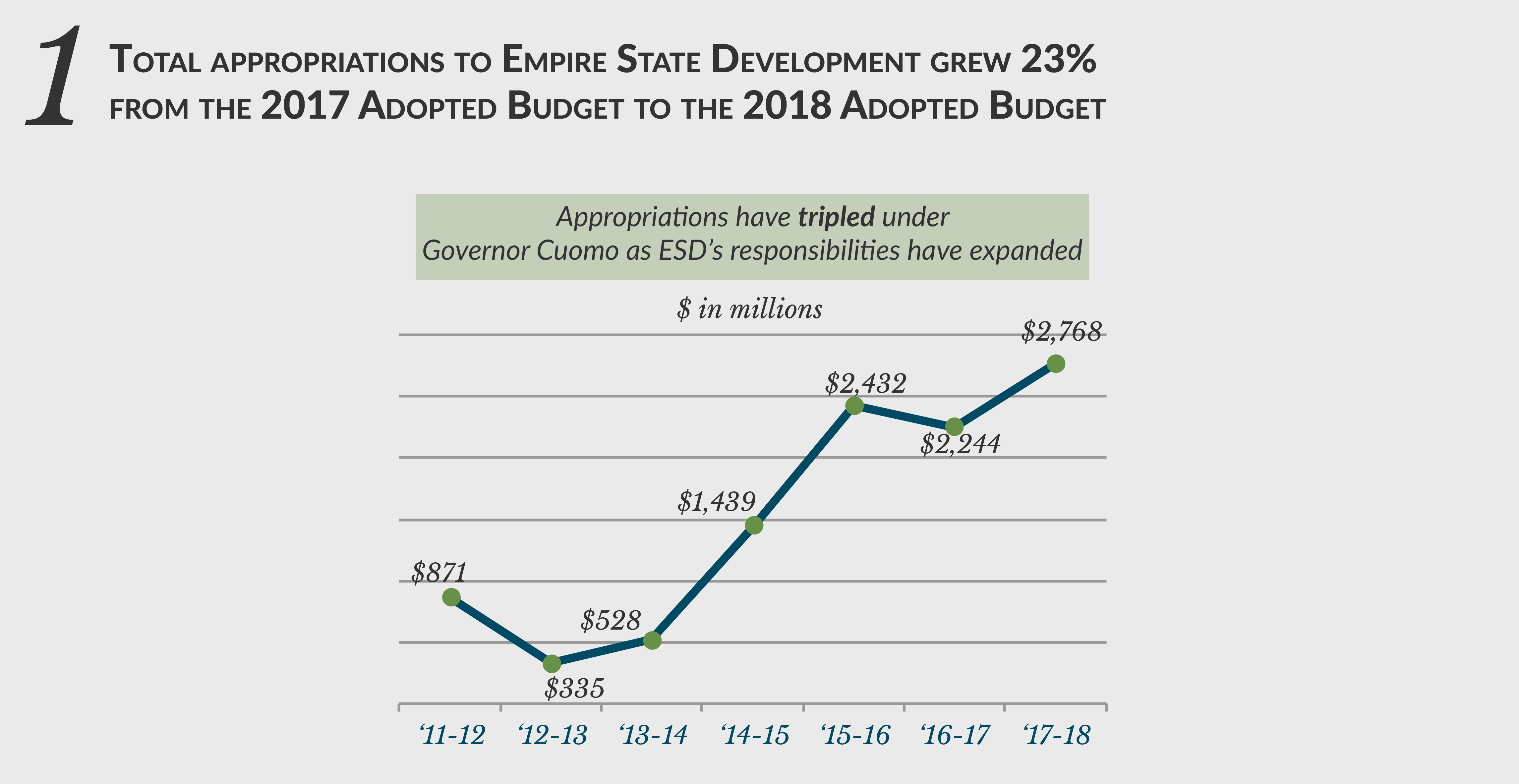

Budget Negotiations New York NOW THIRTEEN New York Public Media

Economic Development in the New York State Budget CBCNY